Since this has been a cash-only month, I have checked my online credit card account just a few times (not CC1, but my Chase one). All of a sudden, I noticed that now I have a $5,000 credit limit instead of a $3,500. Wait, what?! Why?! Nobody told me of this! I click through and see that they've also increased my cash advance to $1,000 from $600. Interest is still 19.99%.

Is this a way to entice me to take on more debt? Funny how it comes within a month of me closing a $3,600 LOC from Dell and having fully paid of my BoA account, which shall remain open for credit score purposes. I've never paid a cent of interest on my Chase card and I intend to keep it that way.

While researching how this would affect my credit score, it seems it will hit positively, if at all, since I don't carry a balance anymore (go me!). I still would've liked some notice...

Update: Bank of America felt like charging a vindictive last fee, so I had to add $12.44 to my budget. Meh, I don't care. It's the last cent of interest they'll see out of me for a long time, if not ever!

Thursday, January 31, 2013

Paycheck 02 Recap

January is gone, and this second half wasn't as good as the first half. Here are my boring stats. I went over on the personal. I blame it on getting the mouse for my laptop (ended up getting 2 for the price of one), plus the unexpected Sharpies for my teacher friend, plus shipping those. But overall, it all balanced out since I didn't spend as much on foods. This coming paycheck will not have that much luck, as my pantry is starting to look sad.

Snowflakes went as planned, and I put in the extra $735 from the bonus, which went as another snowball to finish my CC1. I'm starting to feel a lot better by the day about having no credit card debt. CC2 is a closed credit card, so I don't really consider it as such... it also has a 0% interest while in repayment.

I've been exploring financial books, and I recently got "I'll Teach You To Be Rich" by Ramit Sethi. It was on sale at Amazon for $2 (Kindle version, originally $9.50'ish). I got this book for 2 reasons; I am secretly craving to get a Kindle reader but I know I can't afford it and won't even go there. But I am also testing to see if I'm ok reading books on a reader, and my computer simulates that. So far, so good! Still wont get a Kindle (cue in sad face... again).

I did not get the book for the title... I was actually a bit discouraged by it. But we'll see. I started reading it a bit, and I'm charmed so far. I'll do an unofficial review of it once I'm done. I'll also check the recommendation for The Wealthy Barber. Cash month #1 is done and a success. I'll continue it on February. If it ain't broke, don't fix it, right?

Snowflakes went as planned, and I put in the extra $735 from the bonus, which went as another snowball to finish my CC1. I'm starting to feel a lot better by the day about having no credit card debt. CC2 is a closed credit card, so I don't really consider it as such... it also has a 0% interest while in repayment.

I've been exploring financial books, and I recently got "I'll Teach You To Be Rich" by Ramit Sethi. It was on sale at Amazon for $2 (Kindle version, originally $9.50'ish). I got this book for 2 reasons; I am secretly craving to get a Kindle reader but I know I can't afford it and won't even go there. But I am also testing to see if I'm ok reading books on a reader, and my computer simulates that. So far, so good! Still wont get a Kindle (cue in sad face... again).

I did not get the book for the title... I was actually a bit discouraged by it. But we'll see. I started reading it a bit, and I'm charmed so far. I'll do an unofficial review of it once I'm done. I'll also check the recommendation for The Wealthy Barber. Cash month #1 is done and a success. I'll continue it on February. If it ain't broke, don't fix it, right?

Tuesday, January 29, 2013

Financial Books

Sure, why would anyone need a book when you have the blogosphere... but hey, thought I'd ask. Especially if it keeps me reading!

If you've read any particular personal finance book (from budgeting to investing to retirement savings), can you recommend me one I may be able to find at a library or buy online if it's an spectacular one? I have a few in my mind that I'll research once I'm done with the current book I'm reading (starting with Ramsey's of course), but I'd like to get your opinion and input as well.

With a recommendation, let us know what's the single best piece of advice you found in the book, or how it gave you a different perspective on things. Or if you've done a review of the book somewhere in your blog, I'd love to read it.

Thanks in advance!

If you've read any particular personal finance book (from budgeting to investing to retirement savings), can you recommend me one I may be able to find at a library or buy online if it's an spectacular one? I have a few in my mind that I'll research once I'm done with the current book I'm reading (starting with Ramsey's of course), but I'd like to get your opinion and input as well.

With a recommendation, let us know what's the single best piece of advice you found in the book, or how it gave you a different perspective on things. Or if you've done a review of the book somewhere in your blog, I'd love to read it.

Thanks in advance!

Monday, January 28, 2013

Where did that battery go?!

Apparently, there is a ghost in the tiny bitty room I rent. On Saturday night, I was passing some photos from my camera, which required me to take the battery out of the camera to get to the memory card. I was all bundled up in bed (because it was freezing!), and placed the battery somewhere in the comforter. Later, I had to get out of bed to grab something, and I heard the battery go down between the bed and the wall. The bed is in one corner of the room touching two walls. I thought: "No big deal, I'll retrieve it in the morning." Besides, who wants to move the mattresses and make noise at 9pm?

So I let it go. The next day, I went under the bed looking for it. Odd; I couldn't find it. I looked a bit harder, then harder, then a lot harder. I stripped the bed, I took the mattress and leaned it against the opposite wall, same with the box spring. I took the whole bed frame apart (it's a simple wooden skeleton type). I couldn't find the battery. I emptied sealed boxes that were under the bed with my summer clothes. Nothing. I looked inside every shoe under the bed and nothing. Then I put the bed together again and emptied the closet, every single drawer, every single box or container and it wasn't there.

3.5hrs later of ransacking a room that's only 12.5ft x 9ft, I stripped the bed again, took pillows out of pillow cases, undid everything... and put it back together. No battery. I retraced the few steps I may have given between my room, the bathroom and the kitchen area, in the strangest case that maybe it got lugged in my hoodie and made off with me outside my room. Nothing still. Asked the landlords and they haven't seen it either.

So, how do you deal with these ghosts that take your stuff and make them disappear into thin air? Am I supposed to offer a sacrifice in exchange for my camera battery?!

|

| Camera and battery are this exact same model |

So I let it go. The next day, I went under the bed looking for it. Odd; I couldn't find it. I looked a bit harder, then harder, then a lot harder. I stripped the bed, I took the mattress and leaned it against the opposite wall, same with the box spring. I took the whole bed frame apart (it's a simple wooden skeleton type). I couldn't find the battery. I emptied sealed boxes that were under the bed with my summer clothes. Nothing. I looked inside every shoe under the bed and nothing. Then I put the bed together again and emptied the closet, every single drawer, every single box or container and it wasn't there.

3.5hrs later of ransacking a room that's only 12.5ft x 9ft, I stripped the bed again, took pillows out of pillow cases, undid everything... and put it back together. No battery. I retraced the few steps I may have given between my room, the bathroom and the kitchen area, in the strangest case that maybe it got lugged in my hoodie and made off with me outside my room. Nothing still. Asked the landlords and they haven't seen it either.

So, how do you deal with these ghosts that take your stuff and make them disappear into thin air? Am I supposed to offer a sacrifice in exchange for my camera battery?!

Saturday, January 26, 2013

Future Collage & Recon Vacation

Right now I'm thinking of...

... where I'll end and what my budget will be in 2 years when I move.

I was also looking at travel... Since I have an open plan (read: no plan) for my next vacation, I hired William Shatner to find me a nice vacation package somewhere in Chicago, and the cheapest came to $2,600 for 10 days; hotel, rental car and flights. Sorry, Will. That won't do.

I was also looking at travel... Since I have an open plan (read: no plan) for my next vacation, I hired William Shatner to find me a nice vacation package somewhere in Chicago, and the cheapest came to $2,600 for 10 days; hotel, rental car and flights. Sorry, Will. That won't do.

I leisurely played with the settings and decided to change the dates... and location. I found a hotel in the heart of where I want to move to, a suburb about 30mi from Chicago. The hotel happens to belong to the same chain I work, so I get my pick of $219~$379/ni rooms for $39~$79/ni. A 5 day stay for a mere $200 before taxes.

I can't fight with flights a lot (maybe I could borrow Michelle's discount for a few days...). However, I've noticed my credit card will sometimes display a bit of a cheaper rate. Pair that up with Yapta.com to track the flight prices, and time is on my side. That $370 flight can be snatched for $300 at the right time, and I'm not in any hurry. Best prices to buy tickets are on Tuesdays between 1pm and 4:30pm, if you ever wondered.

I've never rented a car before, but since my company has several frequent fliers, I've learned a few things. Did you know that if your employer has corporate accounts with car rental places, some extend discounts (between 5-15% the rate) to employees, even if the company's not being billed for it? I've also picked up all the good tips, like leave the tank full or pay upwards $35/gal of gas, keep your receipts, over-book instead of under-book (so if you think you'll need the car between 5-10 days, book it for 12; you can return it early and get your money back, penalty free, but extensions will cost you).

All in all, this imaginary 'recon' vacation to explore the area I'd move would cost me about $800 plus food. That's not bad at all.

At the end of the day, I close all the websites, and I feel smugly satisfied with myself. Ah, it will be a nice, lazy weekend. Hope yours is as well!

I was also looking at travel... Since I have an open plan (read: no plan) for my next vacation, I hired William Shatner to find me a nice vacation package somewhere in Chicago, and the cheapest came to $2,600 for 10 days; hotel, rental car and flights. Sorry, Will. That won't do.

I was also looking at travel... Since I have an open plan (read: no plan) for my next vacation, I hired William Shatner to find me a nice vacation package somewhere in Chicago, and the cheapest came to $2,600 for 10 days; hotel, rental car and flights. Sorry, Will. That won't do.I leisurely played with the settings and decided to change the dates... and location. I found a hotel in the heart of where I want to move to, a suburb about 30mi from Chicago. The hotel happens to belong to the same chain I work, so I get my pick of $219~$379/ni rooms for $39~$79/ni. A 5 day stay for a mere $200 before taxes.

I can't fight with flights a lot (maybe I could borrow Michelle's discount for a few days...). However, I've noticed my credit card will sometimes display a bit of a cheaper rate. Pair that up with Yapta.com to track the flight prices, and time is on my side. That $370 flight can be snatched for $300 at the right time, and I'm not in any hurry. Best prices to buy tickets are on Tuesdays between 1pm and 4:30pm, if you ever wondered.

I've never rented a car before, but since my company has several frequent fliers, I've learned a few things. Did you know that if your employer has corporate accounts with car rental places, some extend discounts (between 5-15% the rate) to employees, even if the company's not being billed for it? I've also picked up all the good tips, like leave the tank full or pay upwards $35/gal of gas, keep your receipts, over-book instead of under-book (so if you think you'll need the car between 5-10 days, book it for 12; you can return it early and get your money back, penalty free, but extensions will cost you).

All in all, this imaginary 'recon' vacation to explore the area I'd move would cost me about $800 plus food. That's not bad at all.

At the end of the day, I close all the websites, and I feel smugly satisfied with myself. Ah, it will be a nice, lazy weekend. Hope yours is as well!

Friday, January 25, 2013

Awesome deals at not so awesome times?

How do you go about buying things you (or someone) will need and they go to "stockpiling" prices, but you are not ready to commit to bulk purchases?

I often think about grocery store deals. Those odd times when they have chicken breasts for 79c/lb, or when they put canned tomatoes for 40c. Thankfully, I am limited by my storage/freezer space and can't buy much. But if space wasn't an issue? Where do you draw the line? Do you buy every single item they have out, or maybe just enough to get you through a few months, or just buy a little and hope they go on sale again soon?

I often think about grocery store deals. Those odd times when they have chicken breasts for 79c/lb, or when they put canned tomatoes for 40c. Thankfully, I am limited by my storage/freezer space and can't buy much. But if space wasn't an issue? Where do you draw the line? Do you buy every single item they have out, or maybe just enough to get you through a few months, or just buy a little and hope they go on sale again soon?

Case in point, a friend of mine, who is a middle-school teacher, has been running low on dry-erase markers for school, since the subsidy that they give teachers isn't enough to cover for all materials during a school year.

Normally, Expo markers are about $1.75/ea in single color or variety packs. You can get them on sales for $1.30 most commonly, and I've seen them go as low as $0.90/ea. That was one of those crazy rock-bottom sales with coupons. But this time, the deal was even better, at $1.25 for a pack of 4 assorted colors, or $0.31c/ea. I had to get them. The store only had "about" 37 packs left. I am so glad I was doing cash-only, because a quick browsing to my cash reserve revealed I only had $30. I bought 22 packs for less than $30. Stuff like that made me feel like a million bucks. 88 markers for 33c/ea after tax. I wished that I could've bought more, since my part-time job also uses them and we are always running out, but my funds didn't allow it. This mirrors when I'm at the store looking at amazing deals and knowing that I can't get as much as I wish I could because of space or money.

I will be shipping most of the markers out to my friend, and dropping off the rest at my part time job. No, I'm not charging my friend for the markers... not only because they are the ones that have hosted me (for free) at their house for 3 of my last 4 vacations, even when I insisted on paying for meals, but because they're very dear friends of mine. And yes, I'm aware many people won't be thrilled about this... but I see it not much different than buying things for ones' kids and spouses, neither of which I have. I'm getting things they need for people I like more than my own family members.

So, awesome prices, not so awesome times. Do you borrow from somewhere to take the most advantage of the sale, go strictly with what you need, or play it by ear?

I often think about grocery store deals. Those odd times when they have chicken breasts for 79c/lb, or when they put canned tomatoes for 40c. Thankfully, I am limited by my storage/freezer space and can't buy much. But if space wasn't an issue? Where do you draw the line? Do you buy every single item they have out, or maybe just enough to get you through a few months, or just buy a little and hope they go on sale again soon?

I often think about grocery store deals. Those odd times when they have chicken breasts for 79c/lb, or when they put canned tomatoes for 40c. Thankfully, I am limited by my storage/freezer space and can't buy much. But if space wasn't an issue? Where do you draw the line? Do you buy every single item they have out, or maybe just enough to get you through a few months, or just buy a little and hope they go on sale again soon?Case in point, a friend of mine, who is a middle-school teacher, has been running low on dry-erase markers for school, since the subsidy that they give teachers isn't enough to cover for all materials during a school year.

Normally, Expo markers are about $1.75/ea in single color or variety packs. You can get them on sales for $1.30 most commonly, and I've seen them go as low as $0.90/ea. That was one of those crazy rock-bottom sales with coupons. But this time, the deal was even better, at $1.25 for a pack of 4 assorted colors, or $0.31c/ea. I had to get them. The store only had "about" 37 packs left. I am so glad I was doing cash-only, because a quick browsing to my cash reserve revealed I only had $30. I bought 22 packs for less than $30. Stuff like that made me feel like a million bucks. 88 markers for 33c/ea after tax. I wished that I could've bought more, since my part-time job also uses them and we are always running out, but my funds didn't allow it. This mirrors when I'm at the store looking at amazing deals and knowing that I can't get as much as I wish I could because of space or money.

I will be shipping most of the markers out to my friend, and dropping off the rest at my part time job. No, I'm not charging my friend for the markers... not only because they are the ones that have hosted me (for free) at their house for 3 of my last 4 vacations, even when I insisted on paying for meals, but because they're very dear friends of mine. And yes, I'm aware many people won't be thrilled about this... but I see it not much different than buying things for ones' kids and spouses, neither of which I have. I'm getting things they need for people I like more than my own family members.

So, awesome prices, not so awesome times. Do you borrow from somewhere to take the most advantage of the sale, go strictly with what you need, or play it by ear?

Thursday, January 24, 2013

Hibernating

I am not as excited as I thought I'd be from paying off that wicked Bank of America card... I think the weather has most of my senses in hibernation mode. It's so cold all I really feel like doing is getting home and going to sleep. I hope I'm not the only one. I've been looking for a portable, rechargeable hand warmer. Know of any good ones? I did a quick search and there's loads of lousy ones followed by really expensive ones.

February will be a very boring month overall. This whole stretch between New Year's and Memorial Day is long and uneventful. And cold. I keep thinking that planning a vacation during January and April would be a great idea, but haven't gotten around to it. Perhaps one of these years?

I'm thankful January is slowly coming to a close. It's making me catch up with reading (I'm almost up to 2 books read, and several in queue that I may want to read). But I need better ways to stall this financial restless feeling where I can't do much. Even if I did pay $1,535 in credit card debt and paid off a long-time enemy of mine, I can't feel excited. Maybe I'll get a break in February and get excited about this journey again.

In the mean time, back to hibernation.

February will be a very boring month overall. This whole stretch between New Year's and Memorial Day is long and uneventful. And cold. I keep thinking that planning a vacation during January and April would be a great idea, but haven't gotten around to it. Perhaps one of these years?

I'm thankful January is slowly coming to a close. It's making me catch up with reading (I'm almost up to 2 books read, and several in queue that I may want to read). But I need better ways to stall this financial restless feeling where I can't do much. Even if I did pay $1,535 in credit card debt and paid off a long-time enemy of mine, I can't feel excited. Maybe I'll get a break in February and get excited about this journey again.

In the mean time, back to hibernation.

Tuesday, January 22, 2013

Quick(en) update and CC1

I've set my Quicken for the most part, but I still can't have some of the views work properly (like the calendar view that I so enjoyed). But after putting all of my accounts in it... I discovered, I have a LOT of accounts. 2 checking accounts (BoA, ING), 4 savings accounts (BoA, ING x2, Ally), a Paypal account, 3 credit cards, a "cash" account, 2 investment accounts from my two jobs, a total of 5 student loans account (4 of them are combined into what is known as Student Loan 2, but contain different balances/interest rates). I did close the Dell account I had mentioned, so that's one less off my list. It was an eye opener.

Bringing all of these totals together did put something in perspective... I am almost breaking even with my net worth! If we add my retirement funds (which we shouldn't, since it's not like I have access to that money; and even if I did, there's a 20% tax penalty to touch it), I am about $500 from breaking even into the positives. That was kind of nice to see. My retirement funds almost cancels out my student loan debt. Which means at the credit card level, I'm closing the gap.

Now onto more exciting mess.

I received ("part of"!) our bonus at my full time job. It came to $735 and some change after tax. I also received a much smaller quarterly bonus from my part time job ($67 before tax), but that was bundled to the whole check.

So what did I do with the $735? Sure, it could go chill out with my part-time check, extra from January and become tax funds...

Or it could combine with my scheduled $90 debt repayment for 1/18/13, borrow $60 from my part-time job's check, and do this:

I know, I know. I get waaay too excited to pay things off. And I'll have to 'repay' myself all of that so I can pay my taxes anyway. But hey, this way I am saving about $40 in extra interest. I was so tired of paying interest, anyway, and I hate this card with a passion. So, BoA, adieu. I don't know if you will still charge me interest on this last payment, but even if you do, I'll gladly pay it to see you hit zero.

Bringing all of these totals together did put something in perspective... I am almost breaking even with my net worth! If we add my retirement funds (which we shouldn't, since it's not like I have access to that money; and even if I did, there's a 20% tax penalty to touch it), I am about $500 from breaking even into the positives. That was kind of nice to see. My retirement funds almost cancels out my student loan debt. Which means at the credit card level, I'm closing the gap.

Now onto more exciting mess.

I received ("part of"!) our bonus at my full time job. It came to $735 and some change after tax. I also received a much smaller quarterly bonus from my part time job ($67 before tax), but that was bundled to the whole check.

So what did I do with the $735? Sure, it could go chill out with my part-time check, extra from January and become tax funds...

Or it could combine with my scheduled $90 debt repayment for 1/18/13, borrow $60 from my part-time job's check, and do this:

|

| Bank of America credit card (CC1): Balance = ZERO! |

I know, I know. I get waaay too excited to pay things off. And I'll have to 'repay' myself all of that so I can pay my taxes anyway. But hey, this way I am saving about $40 in extra interest. I was so tired of paying interest, anyway, and I hate this card with a passion. So, BoA, adieu. I don't know if you will still charge me interest on this last payment, but even if you do, I'll gladly pay it to see you hit zero.

Friday, January 18, 2013

Want to know what's a good investment?

Your health. Yes, that. Yes, you already knew that (hopefully!), but there was something that made me think about this last night.

The landlord's mother was chatting with me that she was worried about the landlord's health. He was at a Dr's appointment, and had called her to tell her his results were, well, not very stellar. He already has some health concerns, and his family history is not good at all. The landlord's mother is nearing 80 and has outlived her husband (heart attack at 61), her three younger brothers (two lost to cancer before 65, one lost to heart attach and diabetes), and her two remaining sisters are very sick/disabled with diabetes-related sickness.

I've mentioned that they eat out every. single. meal. Or 97% of them. The landlord lady cooks maybe 3 times a month, but even then, it's mostly pre-packaged stuff (pre-seasoned meats, boxed mashed potatoes, frozen dinners, canned stuff). The landlord returned and he was very ticked off at his dr's appointment results. He seemed genuinely surprised that his numbers were so bad, especially the sodium intake. He actually said "I don't even use salt"... well, you're eating fast food that has enough sodium content to last you a few days! And the doctor told him so. I was a bit surprised he didn't really know that. Or did he?

I've mentioned that they eat out every. single. meal. Or 97% of them. The landlord lady cooks maybe 3 times a month, but even then, it's mostly pre-packaged stuff (pre-seasoned meats, boxed mashed potatoes, frozen dinners, canned stuff). The landlord returned and he was very ticked off at his dr's appointment results. He seemed genuinely surprised that his numbers were so bad, especially the sodium intake. He actually said "I don't even use salt"... well, you're eating fast food that has enough sodium content to last you a few days! And the doctor told him so. I was a bit surprised he didn't really know that. Or did he?

Anyway... with his family history, I'd be super paranoid. Thankfully, my family is overall healthy, but we live in different times, so I can't let my guard down. I eat healthy (for the most part), engage in some exercise and cook all of my meals, so I know exactly what's going in it. It doesn't mean I am doing everything right. I will still eat junk, I don't get 30min/day of exercise most days, and I live a very sedentary lifestyle in general. But I don't play against my health either.

I guess my message tonight is, sure, you're doing the big things to preserve your health, such as getting your yearly exams, avoid eating fast food every day, but are you doing the small stuff too? It's not just about a diet; it's about lifestyle changes. Are you going for small fries instead of big fries? Diet coke vs regular? Juice or water instead of soda or alcohol? Are you parking a bit farther from the door? Using the stairs? Do you really know what you're eating? Is smoking worth it? How about drinking?

It made me sad and uneasy to see him upset about his results... and it slightly bothered me that he seemed surprised that his results were not good. It has also made the house a bit uncomfortable overall, but that's for another day.

Taking care of yourself is not a New Year's resolution. It's something that starts when you're old enough to take care of yourself and goes through until you die. If you can't do a lot, then do a little.

The landlord's mother was chatting with me that she was worried about the landlord's health. He was at a Dr's appointment, and had called her to tell her his results were, well, not very stellar. He already has some health concerns, and his family history is not good at all. The landlord's mother is nearing 80 and has outlived her husband (heart attack at 61), her three younger brothers (two lost to cancer before 65, one lost to heart attach and diabetes), and her two remaining sisters are very sick/disabled with diabetes-related sickness.

I've mentioned that they eat out every. single. meal. Or 97% of them. The landlord lady cooks maybe 3 times a month, but even then, it's mostly pre-packaged stuff (pre-seasoned meats, boxed mashed potatoes, frozen dinners, canned stuff). The landlord returned and he was very ticked off at his dr's appointment results. He seemed genuinely surprised that his numbers were so bad, especially the sodium intake. He actually said "I don't even use salt"... well, you're eating fast food that has enough sodium content to last you a few days! And the doctor told him so. I was a bit surprised he didn't really know that. Or did he?

I've mentioned that they eat out every. single. meal. Or 97% of them. The landlord lady cooks maybe 3 times a month, but even then, it's mostly pre-packaged stuff (pre-seasoned meats, boxed mashed potatoes, frozen dinners, canned stuff). The landlord returned and he was very ticked off at his dr's appointment results. He seemed genuinely surprised that his numbers were so bad, especially the sodium intake. He actually said "I don't even use salt"... well, you're eating fast food that has enough sodium content to last you a few days! And the doctor told him so. I was a bit surprised he didn't really know that. Or did he?Anyway... with his family history, I'd be super paranoid. Thankfully, my family is overall healthy, but we live in different times, so I can't let my guard down. I eat healthy (for the most part), engage in some exercise and cook all of my meals, so I know exactly what's going in it. It doesn't mean I am doing everything right. I will still eat junk, I don't get 30min/day of exercise most days, and I live a very sedentary lifestyle in general. But I don't play against my health either.

I guess my message tonight is, sure, you're doing the big things to preserve your health, such as getting your yearly exams, avoid eating fast food every day, but are you doing the small stuff too? It's not just about a diet; it's about lifestyle changes. Are you going for small fries instead of big fries? Diet coke vs regular? Juice or water instead of soda or alcohol? Are you parking a bit farther from the door? Using the stairs? Do you really know what you're eating? Is smoking worth it? How about drinking?

It made me sad and uneasy to see him upset about his results... and it slightly bothered me that he seemed surprised that his results were not good. It has also made the house a bit uncomfortable overall, but that's for another day.

Taking care of yourself is not a New Year's resolution. It's something that starts when you're old enough to take care of yourself and goes through until you die. If you can't do a lot, then do a little.

Thursday, January 17, 2013

Paycheck 01 Recap

Wow, hopefully this will be my most boring paycheck spending report this year. (Ha, tough chance!)

Because of how I schedule my payments, and as of this minute (prone to change in the next few weeks due to taxes), disposable income for the first paycheck of the month will be $750 and $250 for my second paycheck. Those amounts are what's left after all mandatory payments are made, such as rent, phone and min payment on debt. Does not include any extra income from part time job, which I'll count differently as it comes (if it comes).

Because of how I schedule my payments, and as of this minute (prone to change in the next few weeks due to taxes), disposable income for the first paycheck of the month will be $750 and $250 for my second paycheck. Those amounts are what's left after all mandatory payments are made, such as rent, phone and min payment on debt. Does not include any extra income from part time job, which I'll count differently as it comes (if it comes).

PAYCHECK 01: 1/4/2013

Bills and dues were all paid in full. No hours at part-time job.

The rest ($750) was distributed as follows:

I managed to save $68.18, mostly because I've been a little morose since Christmas. Though it is nice, the fact that it will have to go into a "tax" fund doesn't really make me feel that much better. But off it goes. I'll send $8.18 to become a tiny bitty snowball, just so I can have clean, round numbers. $60 have been added to my tax fund.

I'll cash in my next allowance on Saturday or Sunday to continue with my first all-cash month this year. I probably also need to go grocery shopping at some point. It does make a difference to use all cash vs a debit or same-as-debit credit card.

Because of how I schedule my payments, and as of this minute (prone to change in the next few weeks due to taxes), disposable income for the first paycheck of the month will be $750 and $250 for my second paycheck. Those amounts are what's left after all mandatory payments are made, such as rent, phone and min payment on debt. Does not include any extra income from part time job, which I'll count differently as it comes (if it comes).

Because of how I schedule my payments, and as of this minute (prone to change in the next few weeks due to taxes), disposable income for the first paycheck of the month will be $750 and $250 for my second paycheck. Those amounts are what's left after all mandatory payments are made, such as rent, phone and min payment on debt. Does not include any extra income from part time job, which I'll count differently as it comes (if it comes).PAYCHECK 01: 1/4/2013

Bills and dues were all paid in full. No hours at part-time job.

The rest ($750) was distributed as follows:

I managed to save $68.18, mostly because I've been a little morose since Christmas. Though it is nice, the fact that it will have to go into a "tax" fund doesn't really make me feel that much better. But off it goes. I'll send $8.18 to become a tiny bitty snowball, just so I can have clean, round numbers. $60 have been added to my tax fund.

I'll cash in my next allowance on Saturday or Sunday to continue with my first all-cash month this year. I probably also need to go grocery shopping at some point. It does make a difference to use all cash vs a debit or same-as-debit credit card.

Tuesday, January 15, 2013

15-day trial period: Changing a goal

I am anticipating an additional change to my income figures which may give me another $40/check cut. I'm planning for the worse. As such, I've been thinking long and hard, and I really can't commit to my goal #12 (dine out once a month). It was contradictory to begin with. Though it is a good personal goal for me because I eat/go out maybe 3-4 times a year and I wanted to try to go out more often, it's expensive. And with as many tight financials goals I have, I just can't see it happening. It's already the middle of the month and it stresses me to think I have to go out. I don't feel like it, and if it is stressing me, it's not working as it was supposed to. So it gets scratched off! Do I get a 15-day refund on this goal? Maybe I'll consider alternative goals before the month is over.

Because I didn't really have a budget for these outings, I will just assume that $50 'raise' to myself never happened. It will be shifted to accommodate the new decrease in income. (sad face)

Now, to come up with $30 more to be cut a month without once again changing my budget... because I'm tired of redoing it.

This is all tentative, pending the outcome of my tax 'refunds'. For whatever reason, my full-time employer is not taking near enough taxes for state taxes... which has put me owing too much state tax 3 years in a row. Once I get my W-2 for my part time job, and my tax forms from my student loans (that'll be tricky since the loan got transferred mid year...), I'm filing my taxes. As it stands right now, I am getting a $150 refund for federal and owe 935 for state, or -$785 total. Something's seriously wrong with my state withholding and I'm irritated by it. The figures will change when I receive all of the forms, but I fear the figure will only get slightly more grim. I'm prepared for the worse, though!

My take-home pay will be $80-100 less than last year. Isn't that lovely? I really should re-re-re-reconsider another part time job.

My take-home pay will be $80-100 less than last year. Isn't that lovely? I really should re-re-re-reconsider another part time job.

Friday, January 11, 2013

What I'm up to

This is photographic evidence of me trying to go at three goals...

First, yes! Those are real books! I wandered off to the library yesterday (was supposed to have gone Monday... procrastinators, unite!... tomorrow!). I went in with the goal to pick up one book and go. Then changed it to two and a runner up. Then 3 and a "maybe". In all, I picked up "South Sea Tales" by Jack London, "I Capture The Castle" by Dodie Smith and "Firmin" by Sam Savage. Firmin really caught my eye, and after eating through half of it, I had to stop myself. I'm a speed reader, but I didnt want to read it all in a same day, and trust me, I could've. So, success! If that's the only book of 3 I finish, I'll be content.

Second goal, January will be my first cash-only month. So far, I've spent $40 some in groceries (this photo was taken before an additional $6 trip). I have $59 left in cash until the 18th, so I should be able to do it with no issue.

Last, I know this is simplistic. Overly simplistic, perhaps, but I really wanted to find something to do with sausages that wasn't just a basic stirfry. Still sort of basic I found this Italian Sausage Sauce and it looked simple enough to try. I don't really like zucchini and I wasn't willing to spend $2/lb for very small ones at the store, so I paired it with sweet potato fries. Success! It turned out very delightful. One caveat to my plan, though... people seem to think it's strange to take photos while you cook. So I didn't take many photos. However, I tried and followed the recipe as closely as possible, so I consider this one a success.

I know goals are not everybody's thing, but they help/force me to do things I said I'd do. And I guess that works for me. I'll be working this Saturday for another 7-9 hours (yay!), so have a great weekend, everybody.

First, yes! Those are real books! I wandered off to the library yesterday (was supposed to have gone Monday... procrastinators, unite!... tomorrow!). I went in with the goal to pick up one book and go. Then changed it to two and a runner up. Then 3 and a "maybe". In all, I picked up "South Sea Tales" by Jack London, "I Capture The Castle" by Dodie Smith and "Firmin" by Sam Savage. Firmin really caught my eye, and after eating through half of it, I had to stop myself. I'm a speed reader, but I didnt want to read it all in a same day, and trust me, I could've. So, success! If that's the only book of 3 I finish, I'll be content.

Second goal, January will be my first cash-only month. So far, I've spent $40 some in groceries (this photo was taken before an additional $6 trip). I have $59 left in cash until the 18th, so I should be able to do it with no issue.

Last, I know this is simplistic. Overly simplistic, perhaps, but I really wanted to find something to do with sausages that wasn't just a basic stirfry. Still sort of basic I found this Italian Sausage Sauce and it looked simple enough to try. I don't really like zucchini and I wasn't willing to spend $2/lb for very small ones at the store, so I paired it with sweet potato fries. Success! It turned out very delightful. One caveat to my plan, though... people seem to think it's strange to take photos while you cook. So I didn't take many photos. However, I tried and followed the recipe as closely as possible, so I consider this one a success.

I know goals are not everybody's thing, but they help/force me to do things I said I'd do. And I guess that works for me. I'll be working this Saturday for another 7-9 hours (yay!), so have a great weekend, everybody.

Thursday, January 10, 2013

Budgeting 101

How do you introduce someone to this "budgeting" deal? I know most people have heard the word "budget" and know the general premises of it, but does it really work? Would it apply to me? What are my choices and how do I need to get started?

How do you introduce someone to this "budgeting" deal? I know most people have heard the word "budget" and know the general premises of it, but does it really work? Would it apply to me? What are my choices and how do I need to get started?What do you need to get started? Pencil, paper and time. A spreadsheet or word document in your computer (or uploaded online for easy access) is also a good choice too. Another thing I'd recommend is a calendar you can write on, to put in due dates and other tidbits of info.

First things first... what's your goal? Do you want to have better control of your bills so you're not wondering if you have enough cash to cover expenses? Are you trying to get rid of debt? Mapping a path to save $5,000 for that fancy vacation, new car or party? Save more for your retirement or college funds for the kids? Whatever it is, write it down.

What is budgeting and what can it accomplish?

Budget: (n) An estimate of income and expenditure for a set period of time.

Making a budget is nothing more than being fully aware of where the money is coming from, and where it is going. It is tracking your expenses, recording your income, accounting for all of your bills and sticking to limits you've agreed on. That means that when you get your paycheck, you have a good idea of how that money will be spent, where and when. You also know that you have, i.e., a $100 allowance for food until next paycheck, so going to that restaurant that's going to cost you $60 may be out of the question!

What it will NOT accomplish on its own:

Depending on your debt burden, goals or plans, it may take months or even years to reach where you want to go. The act of creating a budget is not a "get out of jail free" card. It may not solve all of your problems, and it may not let you keep your current lifestyle, if you are living outside of your means. It will only assist and guide you. You have to make the changes.

Now that's out of the way, let's get on with the first phase; gather information and document!

Steps to creating a budget:

1) Know your bills. No, I don't mean monopoly money ones, but your expense/income stats. That means you must gather and document every single utility/ membership bill, every source of income and paycheck, and every expense including estimates of 'possible' expenses like that cousin's wedding in June, your son's yearbook or your pet vet visits. Don't hide or exclude irregular side income or ignore a semi-recurrent expense like alcohol or tobacco. Be honest. Write down all due dates and the days you get paid. If you need to estimate things like groceries, look at a 3 month average if possible. Get the best, most realistic picture you possibly can.

1) Know your bills. No, I don't mean monopoly money ones, but your expense/income stats. That means you must gather and document every single utility/ membership bill, every source of income and paycheck, and every expense including estimates of 'possible' expenses like that cousin's wedding in June, your son's yearbook or your pet vet visits. Don't hide or exclude irregular side income or ignore a semi-recurrent expense like alcohol or tobacco. Be honest. Write down all due dates and the days you get paid. If you need to estimate things like groceries, look at a 3 month average if possible. Get the best, most realistic picture you possibly can. 2) Sort, list and categorize the cards. Divide them into fixed income/ expenses and variable income/ expenses. List them side by side and tally them up. Which are mandatory and which are optional/could-do-without? Is your income less than your expenses?

2) Sort, list and categorize the cards. Divide them into fixed income/ expenses and variable income/ expenses. List them side by side and tally them up. Which are mandatory and which are optional/could-do-without? Is your income less than your expenses?3) Analyze. Now that you have the data, take a close look at it. Are some of these items where you think they should be? Are you shocked that some categories are higher or lower than you thought? If you are operating at a deficit (income < expenses), identify things to cut/reduce.

4) Negotiate. Who knew you were paying that much for a particular expense?! Is it something you can ask to have reduced, like credit card interest, electric bills or perhaps something you can reconsider to get a lower rate from a different company, like car insurance or your phone bill? Are there some things you can do without, like a gym membership or cleaning service? If so, make the call and do your research.

4) Negotiate. Who knew you were paying that much for a particular expense?! Is it something you can ask to have reduced, like credit card interest, electric bills or perhaps something you can reconsider to get a lower rate from a different company, like car insurance or your phone bill? Are there some things you can do without, like a gym membership or cleaning service? If so, make the call and do your research.5) Get a monthly calendar and map due dates and paychecks. Visualize, visualize, visualize. Are there any weeks or days when you may not have enough to cover an expense? Highlight them in red and find a solution. You can call the company to change your scheduled due date; most places allow you to move the due-date 7 days ahead or 7 days after. If one of the optional expenses is too high and continuously clashes with the rest of the list making you go into a deficit, can you reduce it/eliminate it in order to break even or even have extra money?

Congrats! You should now have a very basic scheduling system. This doesn't go into all a budget is, but this post is long enough, so I'll gather the other pieces for a later post.

Tuesday, January 8, 2013

Small additional income and extra expenses

This year is already making me nervous. The more I look at my goals, the more it seems I may have to forfeit one or two. But worrying has never done anyone any good, so I'll do the best I can.

I've started January as my first cash-only month. I withdrawed $100 of my $160 allowance, and have gone grocery shopping twice. I think I'll be a-ok.

Now, onto additional income:

1) Who knew you could return unused, unopened contact lenses for a credit? I didn't! I returned 3 out of 8 boxes I bought December 2011 because my prescription changed. They're giving me a credit of $58 in the next two weeks! It's going to my CC1, and I think I'll just apply it as a payment, since I wont need more contact lenses until the spring/summer.

2) Part time work! My pay there will take a big hit (increased retirement deductions, increased taxes and W4 changes from 1 to 0 withholding). However, I worked this past Saturday for about 7 hours, and I'm scheduled to be in this coming Saturday for another 7hrs. This is very unusual that I'd be working this early in the year, since normally the "slow season" extends through late March where there are no hours for part time people. I'm grateful for any hours I can get, even if it's just a few. (Estimated at about $130 total)

3) This one isn't due until the end of February, but I have a $24 rebate coming that will most likely be applied as a snowflake somewhere.

Upcoming expenses:

1) Was referred to a dermatologist by my doctor, and that's going to be $50 a visit. Not happy, but my appointment is on February, along with another follow up. No worries, I'm alright. Just have to get something checked since my doctor couldn't figure it out.

2) My laptop mouse is agonizing. I can do without the mouse, but I much prefer using one. That's not expensive at all... about $20, but I don't want to spend that now.

3) Not due anytime soon, but I really need to start thinking about fixing the car's windows. I don't want to get to 95 degree weather and have 1 working window. I know, who's thinking about 90 degree weather in January?

4) Replacing my phone is a big, big big want of mine. I will know more of the costs of this once February drops by, and if I can't afford to replace it, then I may go for something different.

One week in January down, 4 to go.

I've started January as my first cash-only month. I withdrawed $100 of my $160 allowance, and have gone grocery shopping twice. I think I'll be a-ok.

Now, onto additional income:

1) Who knew you could return unused, unopened contact lenses for a credit? I didn't! I returned 3 out of 8 boxes I bought December 2011 because my prescription changed. They're giving me a credit of $58 in the next two weeks! It's going to my CC1, and I think I'll just apply it as a payment, since I wont need more contact lenses until the spring/summer.

2) Part time work! My pay there will take a big hit (increased retirement deductions, increased taxes and W4 changes from 1 to 0 withholding). However, I worked this past Saturday for about 7 hours, and I'm scheduled to be in this coming Saturday for another 7hrs. This is very unusual that I'd be working this early in the year, since normally the "slow season" extends through late March where there are no hours for part time people. I'm grateful for any hours I can get, even if it's just a few. (Estimated at about $130 total)

3) This one isn't due until the end of February, but I have a $24 rebate coming that will most likely be applied as a snowflake somewhere.

Upcoming expenses:

1) Was referred to a dermatologist by my doctor, and that's going to be $50 a visit. Not happy, but my appointment is on February, along with another follow up. No worries, I'm alright. Just have to get something checked since my doctor couldn't figure it out.

2) My laptop mouse is agonizing. I can do without the mouse, but I much prefer using one. That's not expensive at all... about $20, but I don't want to spend that now.

3) Not due anytime soon, but I really need to start thinking about fixing the car's windows. I don't want to get to 95 degree weather and have 1 working window. I know, who's thinking about 90 degree weather in January?

4) Replacing my phone is a big, big big want of mine. I will know more of the costs of this once February drops by, and if I can't afford to replace it, then I may go for something different.

One week in January down, 4 to go.

Saturday, January 5, 2013

Philosophical break

I remembered something Judy said not too long ago about charity, and she always has a point. Even though I wanted to report how every penny of my non-bill money is spent, I won't be reporting any amounts for charity, since (as they say) that's between me and my God. But since it's a goal of mine to help 13 causes, I'm happy to report I've taken the first step and contributed to one yesterday.

This year has thus far been rather unkind to me, so I'll turn the other cheek and be nice to others. I think that instead of reporting in the future, I'll just follow a rather strange goal-tracking bar to the right (below my EF funds), from 0 to 13. Once the goal has been met, it will just be removed and marked as complete in my Goals tab.

"It is the greatest of all mistakes to do nothing because you can only do little."

While looking at the topic though, that quote came up... and it is so true. Especially with the whole debt situation, or life in general. Sure, it may be just $20. Sure, it may just be a 4% reduction in premiums. Sure, it may only be a snowflake in the form of pennies. But it is something. Likewise, it may just be parking at the back instead of next to the entrance. It may just be taking the stairs up. It may just be packing your lunch twice a week. It may be just a 2min call to say hi. Every little counts. Let's make it count!

Hope everyone has a great weekend. I'll go back to my scheduled nonsense on Monday.

Friday, January 4, 2013

Credit Report check

I've decided that instead of doing all 3 free credit reports at once (from annualcreditreport.com), I'd stagger them as some people recommend. That way I can check every 4 months to make sure nothing that shouldn't be there makes it there, and if they do, it gives me a good chance to catch it earlier than if I pull all 3 reports at once every 12 months.

So I pulled my first one, and things are pretty much as they should. No new inquiries that shouldn't be there, the newest one being from when I got my Chase credit card in February.

Looking at the report got me thinking... this is just the report. Last time, I pulled the report and talked myself into buying my score (I can't remember specifically, but it was December 2011 and my score was 67x). I would love to see what it is again, since I've paid down over $5000 in debt... but that's just mere curiosity and don't want to spend $8 for curiosity's sake. I hope my score is a lot higher, just because. And because I want to buy a car in a year or so.

Another thing that came to mind that somehow I hadn't noticed before... when I bought my laptop, I used Dell's payment program, which is like a Dell line of credit. Which is a line of credit, for all intent and purposes. That line's been paid in full for a long long time now, but it's still "open". It has a $3,600 limit on it. Should I close it? From what I know of credit and its calculations, they also take into consideration the amount of credit available. But if I pay down all my debt, do I still need that much credit scattered around? In total, I have $11,100 in credit (with only a 14% utilization ratio... go me!). But perhaps I don't need that much credit to begin with? Chances are I won't use the account, since now I know a lot better, and if I was to buy a new laptop, I'd save for it and pay it in full with cash.

Wish they'd stop being so secretive about this credit score fiasco and tell you what exactly affects your score and how it's calculated. Nothing spells "fishy" and "fiasco" like hiding the calculations.

So I pulled my first one, and things are pretty much as they should. No new inquiries that shouldn't be there, the newest one being from when I got my Chase credit card in February.

Looking at the report got me thinking... this is just the report. Last time, I pulled the report and talked myself into buying my score (I can't remember specifically, but it was December 2011 and my score was 67x). I would love to see what it is again, since I've paid down over $5000 in debt... but that's just mere curiosity and don't want to spend $8 for curiosity's sake. I hope my score is a lot higher, just because. And because I want to buy a car in a year or so.

Another thing that came to mind that somehow I hadn't noticed before... when I bought my laptop, I used Dell's payment program, which is like a Dell line of credit. Which is a line of credit, for all intent and purposes. That line's been paid in full for a long long time now, but it's still "open". It has a $3,600 limit on it. Should I close it? From what I know of credit and its calculations, they also take into consideration the amount of credit available. But if I pay down all my debt, do I still need that much credit scattered around? In total, I have $11,100 in credit (with only a 14% utilization ratio... go me!). But perhaps I don't need that much credit to begin with? Chances are I won't use the account, since now I know a lot better, and if I was to buy a new laptop, I'd save for it and pay it in full with cash.

Wish they'd stop being so secretive about this credit score fiasco and tell you what exactly affects your score and how it's calculated. Nothing spells "fishy" and "fiasco" like hiding the calculations.

Thursday, January 3, 2013

Tax increase...

My first paycheck of the year reflected the 2% tax increase, or $30 taken out of each paycheck, which seems to me more than 2%, but I don't feel like breaking it down to be honest! I know it sounds small and insignificant... but considering my non-debt allowance is only $160/check, it sucks.

With my spanking new 4% uber super awesome car insurance discount (which they conveniently forgot to apply to my renewal bill and I'll have to call about in Feb), I can help pay for this. Well, not with that meager discount, but I over planned my insurance bill by $5/mo, with the hopes I'd have $30 extra to sneak as a very small snowball at the end of each 6-month period. Not anymore!

Here are the adjustments to my budget to accommodate the extra $30:

Here are the adjustments to my budget to accommodate the extra $30:

-From paycheck 1: $5/mo reduction for car ins savings, $10 from my "I was almost implemented!" $50 extra money, and $15 will come out debt repayment. But since I got excited and paid the credit card snowball this morning instead of waiting for the check to post on Friday (can I get Rhitter's URAH for a snowball the size of $590?!!), the $15 for this month will also come from my extra.

-From paycheck 2: $30 reduction in my debt snowballs.

This planning is all preliminary, as I have a lot of toying to do. I'm afraid before January is over, I'll receive more challenges/surprises (namely, tax bill!). This year is the year of surprises. Let's just hope there are some nice surprises later on.

With my spanking new 4% uber super awesome car insurance discount (which they conveniently forgot to apply to my renewal bill and I'll have to call about in Feb), I can help pay for this. Well, not with that meager discount, but I over planned my insurance bill by $5/mo, with the hopes I'd have $30 extra to sneak as a very small snowball at the end of each 6-month period. Not anymore!

Here are the adjustments to my budget to accommodate the extra $30:

Here are the adjustments to my budget to accommodate the extra $30:-From paycheck 1: $5/mo reduction for car ins savings, $10 from my "I was almost implemented!" $50 extra money, and $15 will come out debt repayment. But since I got excited and paid the credit card snowball this morning instead of waiting for the check to post on Friday (can I get Rhitter's URAH for a snowball the size of $590?!!), the $15 for this month will also come from my extra.

-From paycheck 2: $30 reduction in my debt snowballs.

This planning is all preliminary, as I have a lot of toying to do. I'm afraid before January is over, I'll receive more challenges/surprises (namely, tax bill!). This year is the year of surprises. Let's just hope there are some nice surprises later on.

Goals at a Glance + At hand

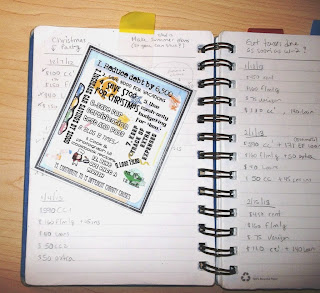

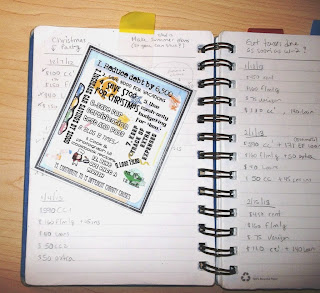

I can't remember who, but someone made a board like this for their goals during 2012 (I think Serendipity?). I decided to make one for myself! On Tuesday, I spent a lot of time sorting out my budget and making sure everything matched on the spreadsheets vs what's on my book. Not surprisingly, the spreadsheet was off. Then I added a "small change" that completely threw both the book and the spreadsheets out the window, and spent too much time fixing it up.

I kept referring back to my goals and what exactly they were, so I decided to print it out pocket size to put in my book. I wish I could laminate it, but I'm perfectly happy with the pretty print! How's that for a visual?

I kept referring back to my goals and what exactly they were, so I decided to print it out pocket size to put in my book. I wish I could laminate it, but I'm perfectly happy with the pretty print! How's that for a visual?

As for the "small change"... I'm taking $50 from my debt payments per month to use as extra/personal. Since every extra bit of money will be destined somewhere, this wiggle room will help me hopefully meet with my last 4 goals: buy books to read if the library doesn't quite have what I'm looking for; cook more, which may mean ingredients not in stock; dine out; give to charity. I know it's a small amount (perhaps too small to make much of a difference), but I think it's a good start.

I kept referring back to my goals and what exactly they were, so I decided to print it out pocket size to put in my book. I wish I could laminate it, but I'm perfectly happy with the pretty print! How's that for a visual?

I kept referring back to my goals and what exactly they were, so I decided to print it out pocket size to put in my book. I wish I could laminate it, but I'm perfectly happy with the pretty print! How's that for a visual?As for the "small change"... I'm taking $50 from my debt payments per month to use as extra/personal. Since every extra bit of money will be destined somewhere, this wiggle room will help me hopefully meet with my last 4 goals: buy books to read if the library doesn't quite have what I'm looking for; cook more, which may mean ingredients not in stock; dine out; give to charity. I know it's a small amount (perhaps too small to make much of a difference), but I think it's a good start.

Wednesday, January 2, 2013

Day 2: Not so good!

This year has already demonstrated it will be very, very defiant and be very mean because it can. It's already flexing its muscles, and boy, can it kick. The 1st was very tough and the 2nd's just moving right along with the plan. But no worries, I'll let it rage until it tires itself out. Hopefully soon!

Anyway, onto some insurance stuff.

5 or so months ago, I mentioned I went into the Progressive Snapshot program. For those of you unfamiliar with it, Progressive (car insurance) offers a discount based on your driving habits. You plug in this device in your car and it tracks certain things. In my mind, I was thinking, "you know, my parents got an 18% (out of 30% possible) discount on this particular car, under my driving (plus theirs). They look at 3 things: times the car is driven, hard stops and average miles. Considering my parents were driving the car at absurd hours of the night on a daily basis, for at least 150mi/day average and clocking in over 20 hard stops per 5mi drive, I can do a lot better!"

And so I did. I finished with 21mi daily average, 11 hard stop per week average and only 17hrs of risk-time driving total. My parents got an 18% on that particular car with a lot worse stats. What did I get? 4%. I was ticked off. I know I should be like, "free money!", but yeah. No. I wanted an explanation.

Long story short, the first rep was condescending, since I already have pretty much bare-bone coverage. Then transferred me to one who was not very helpful, but pretty much told me that because my rate is so low already (one driver, one car, close to minimum coverage), I get a lousy discount.

Never mind I'm a decent driver; they can only discount the rates by so much. Ok. Fair enough. I wish they would've told me 6 months ago, so I wouldn't stress and get upset at the hard stops I made by mistake (like 3 mornings ago), or trying to hoard the car away from my parents so they wouldn't put unnecessary miles.

4%, I'll take it, I guess. It comes down to a $8 reduction off my 6-month policy. Not content, but I'll take it. I wouldn't have stressed out about it, though. I probably would've skipped it altogether. I'm very ticked off, and if it wasn't because all extra money I get this year is going into savings, I'd go buy myself a $8 dessert to make up for it. Progressive, you suck.

4%, I'll take it, I guess. It comes down to a $8 reduction off my 6-month policy. Not content, but I'll take it. I wouldn't have stressed out about it, though. I probably would've skipped it altogether. I'm very ticked off, and if it wasn't because all extra money I get this year is going into savings, I'd go buy myself a $8 dessert to make up for it. Progressive, you suck.

Subscribe to:

Comments (Atom)