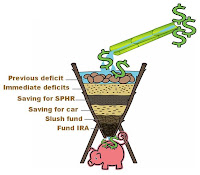

I guess I can consider the leftover from my vacation funds as extra cash, since it was supposed to be spent, but wasn't. The total amount left in the pot is $400 (give or take $5). If I am to stuck to what I had said to do with extra cash, then it would fall into the car fund filter, slush fund filters and IRA filters. How I distribute it doesn't really matter a whole lot, but I was thinking $100 to car fund, $200 slush fund and $100 IRA. That's option 1.

I guess I can consider the leftover from my vacation funds as extra cash, since it was supposed to be spent, but wasn't. The total amount left in the pot is $400 (give or take $5). If I am to stuck to what I had said to do with extra cash, then it would fall into the car fund filter, slush fund filters and IRA filters. How I distribute it doesn't really matter a whole lot, but I was thinking $100 to car fund, $200 slush fund and $100 IRA. That's option 1. Option 2: Free for all! Just use it/spend it in whatever I want. HAHA. Yeah, no. But had to put it out there for comedic relief...

Option 3: My vacation fund is mostly made out of bonus money or extra paycheck money (from 3-paycheck months, twice a year). Starting next year, I will not use the extra paychecks for vacation funding, and instead, they will go solely to debt or savings. Option 3 is to keep the $400 to save for next year's vacation.

Notice how Snowballs doesn't make it into any of my filters? It's intentional. The reason for this is because snowballs are built into the budget, and I think they're big enough (they're the highest item in my budget, beating rent by $150!). I could make option 4 go for snowballs, but I don't feel it's necessary.

I'm leaning towards #3 because next vacation will be a recon mission... that'll be when I go to IL and scout places to live, maybe visit a few choice neighborhoods and check out the apartment complexes. I'll need to stay somewhere and rent a car plus flight. As of this year, the total cost was close to $700 just to get there and stay. No food, hanging out or anything. Yeah, not fun. And considering I didnt go to Chicago this year, I sure want to do something fun next time I am around.

But yeah. 1,