I applied to PenFed CU today, for the amount of $7500 at 2.49% (haven't gotten a result yet). The reason why it's not a $6k loan is because they cut off 48mo loans at $7499. I want a monthly payment that is small and manageable. I want it as small as I can while still saving on interest, because since this loan may extend past my move-out date, I don't want to be carrying debt when I move to uncertainty, in case I am unable to secure a job right away. And I'm also paranoiac. So let's take a look at this, using Vertex's auto loan calculator. (Have I mentioned I LOVE Vertex? If you haven't checked their spreadsheets, including the debt reduction one, you should!)

This is my current loan plan with PNC. I intend to round off all payments to $200 regardless the amount quoted, so the extra payments cut the loan's life to 32mo instead of 36 or 48. With 4.59% interest, and paying $200/mo, I'd be paying $385 in interest, and having a base payment of $137.06. I love the low payment, but I don't love how much interest I may end up paying compare to other options...

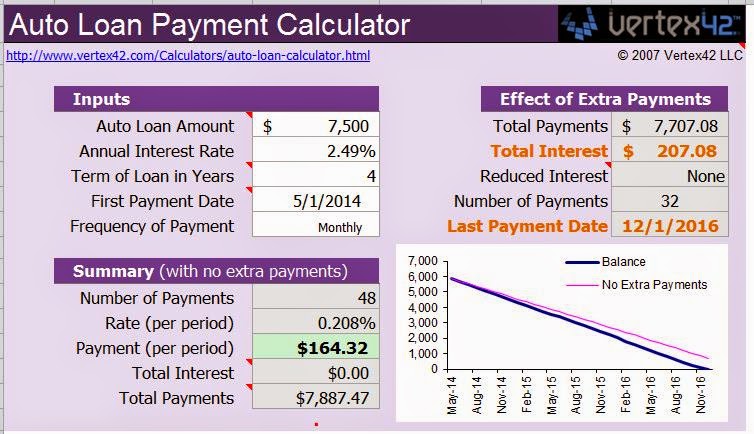

Options such as this one. This would be through PenFed, assuming I am approved, and assuming I am approved at 2.49%. For 48 months, the total loan would be $7500, and I'd make a lump sum payment on the first month of $1500 (bringing the loan to 6000), plus making monthly payments of at least $200. Almost half the total interest paid compared to PNC. Not bad. But the payment is close to $30 more.

One last play through; this is also from PenFed with the same assumptions as above, but 36mo and 6k loan. Payment rises to $173.14 and interest payment is $201. Not enough of a reduction to justify the higher payments, so I am scrapping that option.

Now, let's talk about how I actually plan to pay $200/mo for this.

As much as I love a good challenge, living expenses and savings "debt" for my move would not allow me to simply re-allocate funds towards the full $200. So I intend on borrowing $100/mo from moving budget (creating a $1500 deficit by move out date--ouch), and pay the other $100 in some other creative way, which may be PT job--if I don't quit--, or trying to find another smaller income source. It's just $100/mo, it can't be too hard... right?

And don't worry, if I were to fail to get the remaining monies for $200, I'd just take it from the savings debt. Saving almost half of my income is turning out to be a lot tougher than originally planned.

I don't know much about car loans since we never had one but, I think, you know what you are doing :)

ReplyDeleteI sure hope I do! The process has seem so easy so far.

DeleteLOVE vertex spreadsheets! And finding $100 extra/month would be hard for me without a second job, but I'm confident you'll be able to do it!

ReplyDeleteI hope so too. Trying to stay confident, but I need to work on the details more carefully.

DeleteHow about a credit card? The Citi Simplicity card has 0% Intro APR on balance transfers and purchases for 18 months, pay as much as you can on it, then you can transfer it to another card? the only bad thing is the fee, they range from 3 to 5 %..

ReplyDeleteHS

I don't think I want to chase offers. If I could pay it off in 18mo, I'd consider it, but the fastest I can plan is 32mo.

DeleteI hate the thought of you diving back into debt again when you're so. Close. To being debt free. Can't you find a decent car for $6000 so you aren't going back in the hole? It's not fun deep in the hole, I promise. I'm in here now. And you remember how not fun it was.

ReplyDeleteNo worries, not really going into a hole... at least, this is one I am making for myself. I consider car and housing some expenses I just cant meet in full at the time, and the financing will really help my credit when I do plan for a house. You do bring a good point. I've been considering a car loan similar to a mortgage, but I guess that it can still be considered a sort of personal debt.

Delete