I thought of naming this part "because giving up wasnt a choice", but it was too long. It all started when I was responding to someone's post about how things begin... when the turning point comes out of nowhere, and you can either take it or leave it. Leave it because it looks dirty, full of work, and more trouble than what it's worth at the time, or take a leap of faith into a very uncertain unknown.

That conversation took me back to the time where I could, and probably should have just given up. It started in October 2008. I had less than a month in my current full time job in the auto industry. Right before the recession, which slaughtered a lot of those involved especially with automobile manufacturing and distribution. That night was one of the weird times my parents were openly arguing about money, how they couldn't pay the rent, and how we could be evicted within the next 10 days if they couldnt come up with the money. I didn't sleep for days. I was very fearful, very stressed out, and with no outlet to work through my feelings. The topic was there, but nobody would talk about it. My siblings and I were just supposed to ignore it... something that worked well for them, but not so much for me. It was also about the time my brother left the house because of... irreconcilable differences with my mother. So long, one-peg leg support of all my life. I think I cried all night the first time he was gone and I was alone for the first time in all of my life.

But let's not get wrapped on that. Moving along, it was March 2009, and I was told by my manager that they would probably lay me off by May, so that I should start looking for other jobs and sending resumes. I was the new one, so that choice seemed pretty logical to me. Instead of anger, I was very thankful for the 2-or-so months of notice. I truly was, and to this day I am thankful for it. It wasn't the end of the world for me, I just figured I'd work somewhere else for a while (probably had gone FT at my PT job), until I found something else. The economy was so bad, things were still scary as heck, and I was still pretty much alone, trying to carry on a household in shambles with a lot of nonchalant tenants and quite a lot of sharp, broken pieces of relationships here and there. But April came by. Then May... then June, July, August, a year, two, five. Guess we weathered through and I stayed.

Along all that chaos, I started looking at the mess I was in, as a person, individually, looking at my situation away from my family. I've always had the "group" mentality when it came to them, but this first look was not a pretty sight. A lot of debt, or at least a lot for me, no family support except my father, a broken relationship with the rest of the 6 members, and a job that at the time was undecided whether to keep me or let me go. I was depressed enough my doctor insisted I was medically depressed and needed to be seen by a specialist (I never did, though). She was right, however; I needed help, as I was also slightly suicidal from stress and loneliness. Good thing that I felt like one of those fools that wont commit suicide out of fear of what the neighbors will say. Ha!

Giving up would've been the easy thing to do. Just stop fighting upstream and just pretend things are not happening. Ignore the debts, like my parents had done before me. It worked fairly well for them thus far; we didnt get evicted, we had utilities turned on most of the time, and the welfare part, besides humiliating on my part, did help narrow the void that was inevitably there because of my little income and my mothers' spending. It was... manageable to stay in that chaos. A lot easier than the alternative. And since I've always been a glutton for punishment, I went with the alternative; I decided at that point that something MUST be done.

Something. Anything. I couldn't live like that all my life, I was going to lose it. As much as I'd love to say that I sprang to action valiantly and plowed forward... it wouldn't be until full year later that I pulled myself together and actually DID something about it. But that'll be left for Pt. 3!

Tuesday, April 29, 2014

How's your 401k going?

I am getting a bit aggravated at not being at any place for long. Between going at my parents (and having to work at PT job) and being between where I rent, where I work, and at my parents' again, I've managed to split my things and now I dont know where anything is. To make matters a bit more annoying, there's the knowledge that neither place is a permanent one! I'll be moving out of the rental by July (beginning or end? Not sure yet!), and I havent found any decent postings of places closer to FT job. It's irritating.

I will continue with the next part of my debt-journey review tonight, but for this morning, has anyone noticed their 401k's/IRAs/Retirement funds being more than sluggish? Last year I finished with a 30% rate or return on my FT 401k... this year, almost 4 full months in, I am at -0.92%. Yes, that's a negative! I am not sure if I want to change where I want my funds or sit it out. Right now it's mostly stocks. I am just surprised how much of a difference there is between one year and the next... I shouldnt be, but last year was the first year I actually looked at those numbers, so I am disappointed in this year's performance.

How often do you move your 401k elections? Should I sit it out until it improves, or seek better funds to invest in?

I will continue with the next part of my debt-journey review tonight, but for this morning, has anyone noticed their 401k's/IRAs/Retirement funds being more than sluggish? Last year I finished with a 30% rate or return on my FT 401k... this year, almost 4 full months in, I am at -0.92%. Yes, that's a negative! I am not sure if I want to change where I want my funds or sit it out. Right now it's mostly stocks. I am just surprised how much of a difference there is between one year and the next... I shouldnt be, but last year was the first year I actually looked at those numbers, so I am disappointed in this year's performance.

How often do you move your 401k elections? Should I sit it out until it improves, or seek better funds to invest in?

Friday, April 25, 2014

Debt journey: Years in review (Pt1)

I've been thinking a lot about the past, as I am almost at my last student loan payment. My last "past"/foolish debt payment. My debt journey is still pretty young. I see it something like this:

We moved to the US back in Christmas of 2003. I'm the second born in a family of 7 that had to be uprooted in relatively short notice due to residency matters. In short, my parents had applied to US residency before none of us 5 kids were born. 18 years later, we get the notice that it has finally been approved, and that we have 12 months to move or the application will be withdrawn. Well, isn't that nice?! So off we went.

Back home, my parents were already bad with money. My father who brought home 95% of the income wanted nothing to do with it. He just handed the checks to my mother for her to "manage". My mother was THE Joneses. On the outside, probably the richest of the block, we usually had first access to the new stuff, but on the inside, there was plenty of trouble brewing. Lots of debts. I am still ignorant of how much it was, how much it still is, but it was a LOT. Big and many.

Us kids were overly sheltered from... well, everything. We were never allowed outside, never allowed to handle money (no allowance or purchases of snacks, etc), not allowed to have an opinion, never allowed to go to peoples' houses or to have friends not mother-approved... and let me tell you, she disapproved of her own and my dad's family, so take a guess at how many friends we truly had!

Once we moved to the US, things didn't become that much easier either... a lot of sacrifices, and then came credit cards, pay day loans, and quite a bit of welfare help. Disastrous start, no? It gets worse. For having such a small income, you'd think having debt would just be impossible, but it wasn't. Then me and my brother got into college and graduated both with student loans. We both worked PT during school months, and FT during summer/winter. It seemed that the more income the house got, the worse things got, the more debt that appeared. That's about the time I "got" my first credit card that I didn't know about until another 4 years later... my mother opened them for me, as well as my brother and my dad, and "managed" them. She did pay them on time, but it was incredible how quickly they were all maxed, and then it was the "minimum payment" game forever since.

This is getting long, so I'll stop it here. It brings us to right to the middle of 2008, while I was finishing school, and I still had no idea what I wanted to do when I grew up. It was also a bit before we got the "student loan" mandatory class before graduation, where they throw all sorts of numbers at you. Exciting stuff.

The never ending journey. Climb a mountain, another one will peek through the horizon. Of course, there are always smaller mountains (like car repairs, medical emergencies, etc), so that's why I consider it never ending; big and small mountains, going on and on and on.

Anyway, that's not what I wanted to talk about, but a quick review of what has happened since I first looked at the whole mess that was my debt. Lucky for us, that's only 6 years of history. Talk about making me feel like the kid in the group! For this first part, I'll go over everything that happened first, prior 2008. Take it like a second introduction!

**************************

We moved to the US back in Christmas of 2003. I'm the second born in a family of 7 that had to be uprooted in relatively short notice due to residency matters. In short, my parents had applied to US residency before none of us 5 kids were born. 18 years later, we get the notice that it has finally been approved, and that we have 12 months to move or the application will be withdrawn. Well, isn't that nice?! So off we went.

Back home, my parents were already bad with money. My father who brought home 95% of the income wanted nothing to do with it. He just handed the checks to my mother for her to "manage". My mother was THE Joneses. On the outside, probably the richest of the block, we usually had first access to the new stuff, but on the inside, there was plenty of trouble brewing. Lots of debts. I am still ignorant of how much it was, how much it still is, but it was a LOT. Big and many.

Us kids were overly sheltered from... well, everything. We were never allowed outside, never allowed to handle money (no allowance or purchases of snacks, etc), not allowed to have an opinion, never allowed to go to peoples' houses or to have friends not mother-approved... and let me tell you, she disapproved of her own and my dad's family, so take a guess at how many friends we truly had!

Once we moved to the US, things didn't become that much easier either... a lot of sacrifices, and then came credit cards, pay day loans, and quite a bit of welfare help. Disastrous start, no? It gets worse. For having such a small income, you'd think having debt would just be impossible, but it wasn't. Then me and my brother got into college and graduated both with student loans. We both worked PT during school months, and FT during summer/winter. It seemed that the more income the house got, the worse things got, the more debt that appeared. That's about the time I "got" my first credit card that I didn't know about until another 4 years later... my mother opened them for me, as well as my brother and my dad, and "managed" them. She did pay them on time, but it was incredible how quickly they were all maxed, and then it was the "minimum payment" game forever since.

This is getting long, so I'll stop it here. It brings us to right to the middle of 2008, while I was finishing school, and I still had no idea what I wanted to do when I grew up. It was also a bit before we got the "student loan" mandatory class before graduation, where they throw all sorts of numbers at you. Exciting stuff.

Monday, April 21, 2014

Post surgery, soft foods, cars and spending

I know many people would disagree that a 5-day weekend isn't a weekend off when you're sick or just out of surgery and out of it or in pain, but it was fantastic to have a few days off. FULLY off. No to-do lists outside of taking pain medications, no pending issues besides a lot of napping... We haven't had a real day off since New Year's (plus or minus 2 unscheduled snow days), so I was excited to be off, feeling ill or not. To do it justice, I did nothing at all but rest and I loved it. Back to scheduled madness now.

Surgery went great, and no, I don't remember getting out of the dentist office or taking a rather painful selfie of me with my smile faced bandaid. Everything else went just as well as I could've hoped; bleeding stopped right away, no pulsing throbs yet, a bit of swelling (ok, a LOT of it, but it receded), and little pain. A lot of restricted movement, but little pain. I am happy overall. My follow up will be on Wed (do I have to pay for that appointment? No idea), and hopefully that gives me a clean bill of health.

My brother texted me Sunday that they finally delivered him the letter for the car sale, so once I receive that, hopefully I can "buy" the car. I've made all the payments to it, bringing it to $7,500 (well, $7,434, but who's keeping track). I am hoping I can bring it over to my possession before the month is over. How's THAT for optimism?

Last but not least... outside of $14 worth in pain meds, the $300 in cash for the dentist and about $30 on food to cook with/for my dad, last week was cheap. And for the next 4 days, all I have to buy is something soft but edible (ugh soups and ugh mashed potatoes... maybe I'll get sweet potatoes), and that shouldn't come to more than $15. All the savings will continue to be set aside on a separate savings account until they reach $300, and then moved to my Ally account to partake in any one of my bigger goals... right now, building a much bigger EF is sounding like the best idea.

Hope to catch up with everyone here shortly! Just give me some time. A lot happens in 5 days.

Surgery went great, and no, I don't remember getting out of the dentist office or taking a rather painful selfie of me with my smile faced bandaid. Everything else went just as well as I could've hoped; bleeding stopped right away, no pulsing throbs yet, a bit of swelling (ok, a LOT of it, but it receded), and little pain. A lot of restricted movement, but little pain. I am happy overall. My follow up will be on Wed (do I have to pay for that appointment? No idea), and hopefully that gives me a clean bill of health.

My brother texted me Sunday that they finally delivered him the letter for the car sale, so once I receive that, hopefully I can "buy" the car. I've made all the payments to it, bringing it to $7,500 (well, $7,434, but who's keeping track). I am hoping I can bring it over to my possession before the month is over. How's THAT for optimism?

Last but not least... outside of $14 worth in pain meds, the $300 in cash for the dentist and about $30 on food to cook with/for my dad, last week was cheap. And for the next 4 days, all I have to buy is something soft but edible (ugh soups and ugh mashed potatoes... maybe I'll get sweet potatoes), and that shouldn't come to more than $15. All the savings will continue to be set aside on a separate savings account until they reach $300, and then moved to my Ally account to partake in any one of my bigger goals... right now, building a much bigger EF is sounding like the best idea.

Hope to catch up with everyone here shortly! Just give me some time. A lot happens in 5 days.

Saturday, April 12, 2014

Student Loan Payoff date (as given)

What can I say? I am liking my new "next payment date" for my student loan. I can go by not making another payment until 3/28/2016! Just for fun, I decided to play with math a little bit.

What can I say? I am liking my new "next payment date" for my student loan. I can go by not making another payment until 3/28/2016! Just for fun, I decided to play with math a little bit. Ok, I faked the math part, but just in rough numbers, the remaining amount (ignoring a scheduled $635 payment made Friday) is accruing about $1.50 in interest every 15 days. Rounding numbers here! So let's say it is $0.10/day. From today to 3/28/16 (when my payment is due), the $1560.28 I owe today would add another $71.70 to the loan. It actually does not sound half as bad as I was expecting it.

Can't say I haven't toyed with the idea of forgoing payment for a while longer. However, I am happy to report that the whole train of thought took about 1.5 seconds to be shot down and laughed at. My last payment is next month, on 5/9 or 5/23. Reason for different dates is that I'll only owe about $130 on 5/9, and if I have the funds to do so, I may as well pay it off and be done with it instead of waiting for 5/23.

Update: My payment posted today, so maybe I should play with math again... nah. (It doesn't show the payment yet, but it updated totals)

I can't wait! It's been 5 years coming! The earlier you start with those things, the easier it becomes. I didnt start until a year later, but it still paid off to get going.

Friday, April 11, 2014

March Totals

I didn't think it'd be any interesting to see what happened in March... I knew there were so many unexpected expenses during it that the graph wouldn't make sense for what I consider a standard, but here it is anyway:

Indeed, very messed up. If we take down the three bigger categories, then we may get a better picture, but let's talk about those 3.

Taking those 3 big categories, and we get a better picture:

Indeed, very messed up. If we take down the three bigger categories, then we may get a better picture, but let's talk about those 3.

- Student loans, paid as agreed, no surprise there. I pay way too much extra because I want to get rid of it. My last payment will be in May and I cannot wait!

- Vet expenses... yeah. Our pet Star passed away. I was ticked off we had to pay over $300 for a Vet to see her and he did nothing, and then pay cremation fees the day after. I am not blaming him for her passing, but I just felt he did nothing. Guess we'll never know and I should leave it at that.

- Auto expenses! Yikes! Most of that is tires ($300-some), and then parts to repair what was wrong with the car... parts that need to be put IN the car, but my dad is procrastinating like no other. It's alright, I'll wait. His fee is free vs the $380 the shop was asking for labor. I just want to get it done before something inside the car does break.

Taking those 3 big categories, and we get a better picture:

- My shopping was extremely high, $120 over. Though to be fair, my spending income for that category also went up. This is mostly for work shoes and a few new work shirts. I'm loving them so far! (budget: $80, spent: $200.61)

- Food and dining is definitely up. Between cooking more often, and cooking more often at my parents' house (which means buy the stuff), it went over by about $50 (budget: $120, spent $177.67)

- Gas: Too much going back and forth from work to parents' house to PT job... even 1 extra trip to PT job takes a toll on my gas expense. (budget: $100, spent $123.17)

Everything else is as should be except for Bills&Utilities. I cant find a way to make Quicken account for my phone payments as a bill; instead, it adds it as a negative, which takes away from the total in that category. Pretty annoying, but oh well. I know it's only $50 per month.

Thursday, April 10, 2014

Is it debt free or the highway?

The car loan process is really going a lot slower than I anticipated, perhaps because my brother can only sneak a call at 4am on Fridays or a few minutes during the weekend (when I am working, it appears, so no go).

This made me think of something... ok, most of you know how I feel about credit cards. Sucks big time to pay interest, but can be managed to your advantage. Student loans suck as well, no excuse there. Actually, most debts suck. And some will say that ALL debts suck, no exception. I tend to be of the disagreeing type. I believe debt is a dangerous tool, like a double edged sword with little hilt to grab onto, and if you hold it the wrong way or swing it the wrong way, it will either cut you or cut something/someone else. Makes sense?

So why would I be actually OK with getting this car loan? It IS debt, don't get me wrong. It is money I will owe someone else for about 32 months, and paying them up to $10/mo on top of the borrowed amount just for the privilege of using that money now vs saving it and using it later. Look, I wont try the whole "but let me justify this!". Debt is debt is debt. But it is always as bad as something worth burning at the stake? Is it really reasonable for the average person to bypass some debts?

When I started this journey, I never planned to get a car. That's actually something I started after my little car died in 2011. The car I loved and thought would last me forever, but didn't. I did intend to buy a house eventually, and financing was and is my primary choice. Perhaps my only one at this point. But a car loan? Sure, I could go and get a car, though from what I'd see, I couldn't find anything lower than $9.5k with my very low standard requirements. So though I do have $4k saved, I still need some to complete it. The situation under which I am buying the current car is personal/family, and it's not just those two, but also makes financial good sense. Not BEST sense, but good sense.

In summary, yeah, I am alright getting a loan for the car. I think anything that I can do to protect or improve my 5 basic needs (food, shelter, safety, health, transportation) is worth reconsidering. And since I was going to buy a $10k car anyway, may as well help rebuild some family relations, because let's be honest, it sucks being on your own with such a large family.

On your family, is it debt free or no deal, no exceptions?

This made me think of something... ok, most of you know how I feel about credit cards. Sucks big time to pay interest, but can be managed to your advantage. Student loans suck as well, no excuse there. Actually, most debts suck. And some will say that ALL debts suck, no exception. I tend to be of the disagreeing type. I believe debt is a dangerous tool, like a double edged sword with little hilt to grab onto, and if you hold it the wrong way or swing it the wrong way, it will either cut you or cut something/someone else. Makes sense?

So why would I be actually OK with getting this car loan? It IS debt, don't get me wrong. It is money I will owe someone else for about 32 months, and paying them up to $10/mo on top of the borrowed amount just for the privilege of using that money now vs saving it and using it later. Look, I wont try the whole "but let me justify this!". Debt is debt is debt. But it is always as bad as something worth burning at the stake? Is it really reasonable for the average person to bypass some debts?

When I started this journey, I never planned to get a car. That's actually something I started after my little car died in 2011. The car I loved and thought would last me forever, but didn't. I did intend to buy a house eventually, and financing was and is my primary choice. Perhaps my only one at this point. But a car loan? Sure, I could go and get a car, though from what I'd see, I couldn't find anything lower than $9.5k with my very low standard requirements. So though I do have $4k saved, I still need some to complete it. The situation under which I am buying the current car is personal/family, and it's not just those two, but also makes financial good sense. Not BEST sense, but good sense.

In summary, yeah, I am alright getting a loan for the car. I think anything that I can do to protect or improve my 5 basic needs (food, shelter, safety, health, transportation) is worth reconsidering. And since I was going to buy a $10k car anyway, may as well help rebuild some family relations, because let's be honest, it sucks being on your own with such a large family.

On your family, is it debt free or no deal, no exceptions?

Wednesday, April 9, 2014

Lazy week, busy schedule

Even though I am getting a lot better at cooking meals, with having to drive to parents' house more often and staying longer (hello, night-time working during the weekdays!), cooking really hasn't taken much of a priority. I hate cooking a large batch and not eating it sooner than it starts to lose its flavor, and I REALLY hate throwing food away, because they're money! Down the drain!

Cut carbs from the equation, and I really don't have a whole lot of food options from fast food or pre-made meals that wont cost me an arm and a leg ($4.50 for a frozen Atkins meal? No thanks!). Sometimes I just go for grilled chicken from the deli department, 12 pieces for $10, pair it with 2 bags of frozen vegetables for about $3, and I've got myself dinner for 4 days ($3.25/day, barely a bargain). What's your super short dinner shortcut?

Cut carbs from the equation, and I really don't have a whole lot of food options from fast food or pre-made meals that wont cost me an arm and a leg ($4.50 for a frozen Atkins meal? No thanks!). Sometimes I just go for grilled chicken from the deli department, 12 pieces for $10, pair it with 2 bags of frozen vegetables for about $3, and I've got myself dinner for 4 days ($3.25/day, barely a bargain). What's your super short dinner shortcut?

Tuesday, April 8, 2014

Moving again!

The first time I moved was a bit sad and melancholic. The whole "first time moving out" deal. The next one was rushed, by no plan of my own. Third one was by choice due to... hazardous environment, and here we are again! Time to talk moving plans.

My landlord asked me about my plans, and I was kind enough to be vague. They're a lovely family, but it is a bit restricting timewise and spacewise. Another leading cause is distance; I am half hour farther north. If it was south, it wouldn't be an issue; it'd be midway between parents' house/PT job and FT job. But as it is, it's just too many extra miles that I could do without, not to mention it increased my gas budget to $50 as well as my rent by $50.

It's already April, and my lease is over in July. I could leave early if I asked her, but not yet. I've been looking for postings since February and have not seen anything remotely decent. So disappointing! For my next rental... I REALLY would like it to be back in town, close to my FT job. I was spoiled with my first move, living within 5 min of work. And really, it makes sense. Highest gas savings and time saving. I don't ask for a lot of things besides the basics plus internet. You'd think that'd make me a good, easy target to get rentals, no? Nah. It doesn't. *sad face*

My rental budget is $500 including utilities, which I believe is reasonable for a single room. I mostly rely on Craigslist, because being such a small, in the middle of nowhere town, we don't make it to the newspapers (haven't seen a listing in over 8 months now!), and even the smaller websites don't have local listings. Can't say I am looking forward to packing my stuff again, though I never truly unpacked this time around. Once spring officially starts and it's not cold in the mornings and evenings, I'll pack all of my winter stuff and drop it off to my parents'. The less stuff I have to get ready, the better. And though I normally pack within a weekend, I don't see any harm on getting it done little by little.

My landlord asked me about my plans, and I was kind enough to be vague. They're a lovely family, but it is a bit restricting timewise and spacewise. Another leading cause is distance; I am half hour farther north. If it was south, it wouldn't be an issue; it'd be midway between parents' house/PT job and FT job. But as it is, it's just too many extra miles that I could do without, not to mention it increased my gas budget to $50 as well as my rent by $50.

It's already April, and my lease is over in July. I could leave early if I asked her, but not yet. I've been looking for postings since February and have not seen anything remotely decent. So disappointing! For my next rental... I REALLY would like it to be back in town, close to my FT job. I was spoiled with my first move, living within 5 min of work. And really, it makes sense. Highest gas savings and time saving. I don't ask for a lot of things besides the basics plus internet. You'd think that'd make me a good, easy target to get rentals, no? Nah. It doesn't. *sad face*

My rental budget is $500 including utilities, which I believe is reasonable for a single room. I mostly rely on Craigslist, because being such a small, in the middle of nowhere town, we don't make it to the newspapers (haven't seen a listing in over 8 months now!), and even the smaller websites don't have local listings. Can't say I am looking forward to packing my stuff again, though I never truly unpacked this time around. Once spring officially starts and it's not cold in the mornings and evenings, I'll pack all of my winter stuff and drop it off to my parents'. The less stuff I have to get ready, the better. And though I normally pack within a weekend, I don't see any harm on getting it done little by little.

Thursday, April 3, 2014

The numbers are in! (dentist)

The numbers are finally in after several calls to the dentist! Total cost: $388.40 including anesthesia for an hour. I had most codes printed out, except one, so I had her review with me the codes so I could compare with my insurance's website.

I was still excited, as this is a bit more than $110 savings from my $500 budget, and a lot cheaper than the $200-500 per tooth (total of 4 for me) I kept reading about. However, remembering that piece of forgotten wisdom "ask for a deal, because it doesn't hurt", I asked her about discounts. The lady seemed surprised and said she would check. Guess not many people ask! She said there's a 15% discount if I pay cash on the day of the surgery, bringing the total to $334.14. Score! I also asked if there were any others for paying early, but she said no. No harm, no foul. I'll gladly take the $54 discount.

I will be moving $335 from Ally to my checking account to have it ready. It leaves me with savings of $165 overall. Since I am paying a bulk of my savings into the car down payment, I am going to split this amount between my EF goal and my deficit goal.

I was panicking a little about this whole cat buying experience and what it would do to my ally account. I hadn't noticed, but it's grown to $7000+, which represents all of my savings. It's by far the most money I've ever had. But once I finalize dealings with the car purchase, $4000 will be gone. I'll admit that made me very nervous. I'd still have $3k left, but I don't feel that is enough. I had saved specifically for the car and I knew I'd be gone. I guess I half wish it didn't have to.

So, building my EF and reducing my budget deficits are priorities... And building the monthly car payment. I'm just glad to finally know for sure what my dentist bill would be and not have the nagging thought in the back of my mind that the costs would exceed $900. Phew.

Wednesday, April 2, 2014

Looking at CUs for loans

It's surprising how many few banks offer private-seller auto loans. But there are a few out there, and I'll try to apply to more before the week is over, as they will only count once against my credit score if I get them all in within a 14 day period.

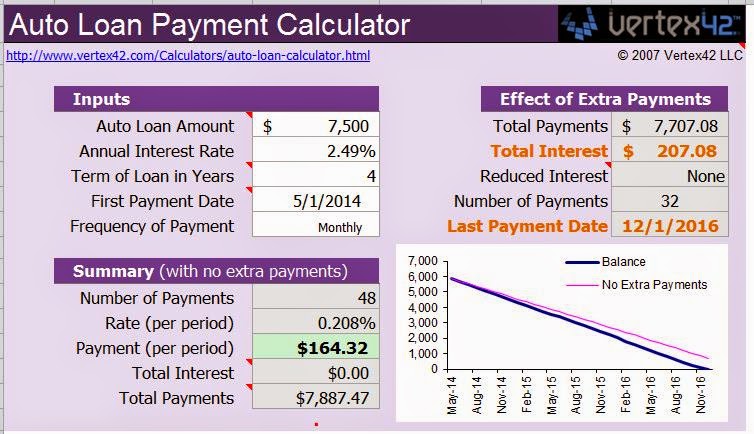

I applied to PenFed CU today, for the amount of $7500 at 2.49% (haven't gotten a result yet). The reason why it's not a $6k loan is because they cut off 48mo loans at $7499. I want a monthly payment that is small and manageable. I want it as small as I can while still saving on interest, because since this loan may extend past my move-out date, I don't want to be carrying debt when I move to uncertainty, in case I am unable to secure a job right away. And I'm also paranoiac. So let's take a look at this, using Vertex's auto loan calculator. (Have I mentioned I LOVE Vertex? If you haven't checked their spreadsheets, including the debt reduction one, you should!)

Now, let's talk about how I actually plan to pay $200/mo for this.

As much as I love a good challenge, living expenses and savings "debt" for my move would not allow me to simply re-allocate funds towards the full $200. So I intend on borrowing $100/mo from moving budget (creating a $1500 deficit by move out date--ouch), and pay the other $100 in some other creative way, which may be PT job--if I don't quit--, or trying to find another smaller income source. It's just $100/mo, it can't be too hard... right?

And don't worry, if I were to fail to get the remaining monies for $200, I'd just take it from the savings debt. Saving almost half of my income is turning out to be a lot tougher than originally planned.

I applied to PenFed CU today, for the amount of $7500 at 2.49% (haven't gotten a result yet). The reason why it's not a $6k loan is because they cut off 48mo loans at $7499. I want a monthly payment that is small and manageable. I want it as small as I can while still saving on interest, because since this loan may extend past my move-out date, I don't want to be carrying debt when I move to uncertainty, in case I am unable to secure a job right away. And I'm also paranoiac. So let's take a look at this, using Vertex's auto loan calculator. (Have I mentioned I LOVE Vertex? If you haven't checked their spreadsheets, including the debt reduction one, you should!)

This is my current loan plan with PNC. I intend to round off all payments to $200 regardless the amount quoted, so the extra payments cut the loan's life to 32mo instead of 36 or 48. With 4.59% interest, and paying $200/mo, I'd be paying $385 in interest, and having a base payment of $137.06. I love the low payment, but I don't love how much interest I may end up paying compare to other options...

Options such as this one. This would be through PenFed, assuming I am approved, and assuming I am approved at 2.49%. For 48 months, the total loan would be $7500, and I'd make a lump sum payment on the first month of $1500 (bringing the loan to 6000), plus making monthly payments of at least $200. Almost half the total interest paid compared to PNC. Not bad. But the payment is close to $30 more.

One last play through; this is also from PenFed with the same assumptions as above, but 36mo and 6k loan. Payment rises to $173.14 and interest payment is $201. Not enough of a reduction to justify the higher payments, so I am scrapping that option.

Now, let's talk about how I actually plan to pay $200/mo for this.

As much as I love a good challenge, living expenses and savings "debt" for my move would not allow me to simply re-allocate funds towards the full $200. So I intend on borrowing $100/mo from moving budget (creating a $1500 deficit by move out date--ouch), and pay the other $100 in some other creative way, which may be PT job--if I don't quit--, or trying to find another smaller income source. It's just $100/mo, it can't be too hard... right?

And don't worry, if I were to fail to get the remaining monies for $200, I'd just take it from the savings debt. Saving almost half of my income is turning out to be a lot tougher than originally planned.

Tuesday, April 1, 2014

$200 to make a point?

Alright, I applied to an auto loan yesterday while searching for info. The loan is through PNC, and the gal I chatted with online was very nice and informative. We processed the loan right there, and I got a reply back in an hour; I was approved for my requested amount ($6000, I'm putting a $4k down payment) over 48mo. Don't worry, I intend to pay it off within less than 32 months.

Speaking of interest... I was shocked when I reviewed mortgage info two years ago, and was completely appalled how expensive mortgages are. In comparison, auto loans don't charge you almost twice the loan price on interest. That $6k loan will only be, at a max, $500 over 4 years, or a little over $10/mo for the life of the loan, assuming I pay it off on schedule and not earlier. I will confess, that's not bad at all. Yes, I'd rather pay no interest, but putting it in perspective... not bad.

Anyway, back to the topic. So the PNC loan was 4.59% for 48mo, $137.06/mo payments. That fits me nicely. Then I went looking into more private party auto loans out there, and I'm surprised there are not many... and those that are out there aren't that great-- about the same APR. Bank of America, on the other hand... they advertise interest as low as 2.59% for the same amount, same term.

Now, let me say this. I hate Bank of America. They were "my" first credit card debt (opened by mother). It sucked SO much money out of me prior to 2012, in overdraft fees (checking), over limit fees, interest... I didn't even total it because the amount was just scary. However, I still have said checking account and credit card. They closed my savings account due to non use, which is fine, because all they offered was a sad 0.10% interest. My credit card was converted from a points based car to one that pays me $30 every quarter just to charge something and pay it off every month, without incurring any interest charges. Works for me. It's also my oldest, so 9 years of good payment history would go if I close the card, which may be a bad idea at the time being.

Back to the loan; I am hesitant to apply. I am not guaranteeing that I will be approved for the very low APR auto loan, but even if I did, I hate BOA. I am willing to risk paying $200 extra JUST not to do business with them. If I were to wait the whole 48 months to pay the auto loan, PNC's total would be $6578 vs $6336 BOA (assuming I get the lowest interest rate). Now, I have to step back a little... am I just being spiteful with my money? Isn't it that savings is savings regardless? Then again, I am someone who has been boycotting Walmart for years and only use them if I must, with my parents, because they're one of two groceries left in town... but is my stubbornness and unwillingness to deal BOA out of principle foolish, or perhaps someone else feels the same way towards certain companies?

Speaking of interest... I was shocked when I reviewed mortgage info two years ago, and was completely appalled how expensive mortgages are. In comparison, auto loans don't charge you almost twice the loan price on interest. That $6k loan will only be, at a max, $500 over 4 years, or a little over $10/mo for the life of the loan, assuming I pay it off on schedule and not earlier. I will confess, that's not bad at all. Yes, I'd rather pay no interest, but putting it in perspective... not bad.

Anyway, back to the topic. So the PNC loan was 4.59% for 48mo, $137.06/mo payments. That fits me nicely. Then I went looking into more private party auto loans out there, and I'm surprised there are not many... and those that are out there aren't that great-- about the same APR. Bank of America, on the other hand... they advertise interest as low as 2.59% for the same amount, same term.

Now, let me say this. I hate Bank of America. They were "my" first credit card debt (opened by mother). It sucked SO much money out of me prior to 2012, in overdraft fees (checking), over limit fees, interest... I didn't even total it because the amount was just scary. However, I still have said checking account and credit card. They closed my savings account due to non use, which is fine, because all they offered was a sad 0.10% interest. My credit card was converted from a points based car to one that pays me $30 every quarter just to charge something and pay it off every month, without incurring any interest charges. Works for me. It's also my oldest, so 9 years of good payment history would go if I close the card, which may be a bad idea at the time being.

Back to the loan; I am hesitant to apply. I am not guaranteeing that I will be approved for the very low APR auto loan, but even if I did, I hate BOA. I am willing to risk paying $200 extra JUST not to do business with them. If I were to wait the whole 48 months to pay the auto loan, PNC's total would be $6578 vs $6336 BOA (assuming I get the lowest interest rate). Now, I have to step back a little... am I just being spiteful with my money? Isn't it that savings is savings regardless? Then again, I am someone who has been boycotting Walmart for years and only use them if I must, with my parents, because they're one of two groceries left in town... but is my stubbornness and unwillingness to deal BOA out of principle foolish, or perhaps someone else feels the same way towards certain companies?

Subscribe to:

Posts (Atom)